News

-

Việt Nam’s IFC takes shape after more than one month since establishment

The centre operates under a 'one centre, two destinations' model in HCM and Đà Nẵng cities, focusing on institutional breakthroughs and modern technological infrastructure.

-

Central bank’s first 2026 directive prioritises inflation control, macro stability

Directive 01/CT-NHNN sets a 4.5 per cent inflation goal and targets around 15 per cent credit growth to safeguard macro stability and sustainable growth.

-

Credit institutions forecast lower pre-tax profit growth in 2026

Credit institutions expect the business outlook to remain positive in 2026 but are more cautious about profit growth, according to the latest survey by the State Bank of Vietnam (SBV).

-

Việt Nam’s real estate credit hits $78b in Q4 2025 as central bank tightens oversight

The Ministry of Construction said real estate credit increased steadily throughout 2025 across housing, office leasing and industrial property, climbing from more than VNĐ1.56 quadrillion in the first quarter to around VNĐ2 quadrillion by year-end.

-

Fitch Ratings upgrades Vietnam’s senior secured long-term debt rating to BBB-

The rating for Vietnam’s secured long-term debt was raised to BBB-, equivalent to investment grade, one notch higher than the country’s long-term foreign-currency rating on unsecured debt, which remains at BB+. The upgrade followed Fitch’s review under its revised Sovereign Rating Criteria issued in last September, said the Ministry of Finance.

-

Interest rate developments applied by credit institutions in December 2025

State Bank of Vietnam has just released the interest rate developments of credit institutions in December 2025.

-

Deposit interest rates exceed 7%, pushing up lending rates

Deposit interest rates at mid-sized banks have continued to rise and surpass the 7 per cent per year mark, causing lending rates to increase.

-

Higher 2026 growth target puts pressure on credit framework

Vietnam’s credit growth framework is set to face mounting pressure as policymakers pursue a significantly higher economic growth target in 2026.

-

Vietnam’s corporate bond market set for a more positive 2026

2026 is set to be a more positive and active year for Vietnam's corporate bond market, bolstered by an improving credit quality trend.

-

Treasury’s idle funds deposited at banks proposed to raise at year end

The Ministry of Finance has recently proposed allowing the State Treasury of Vietnam to increase the cap on idle funds deposited at commercial banks to improve liquidity during the year-end period.

-

Credit growth plans at 15% in 2026, focusing on macroeconomic stability

Under the latest statement on managing credit growth in 2026, the SBV said that this year it will focus on maintaining macroeconomic stability and sustainable development, and control risk areas and real estate.

-

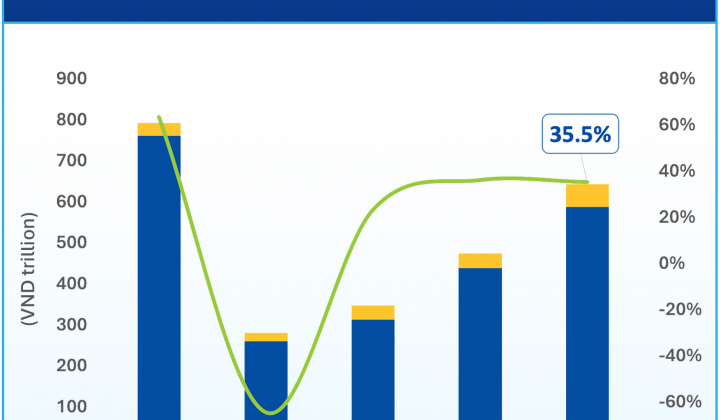

Banks lead the bond market with nearly 590 trillion VND

2025 concluded with many positive signs for the Vietnamese corporate bond market, as the volume of new issuances recorded strong growth, and the issuance structure gradually stabilized compared to the previous period of significant volatility.