News

-

Việt Nam’s real estate credit hits $78b in Q4 2025 as central bank tightens oversight

The Ministry of Construction said real estate credit increased steadily throughout 2025 across housing, office leasing and industrial property, climbing from more than VNĐ1.56 quadrillion in the first quarter to around VNĐ2 quadrillion by year-end.

-

Fitch Ratings upgrades Vietnam’s senior secured long-term debt rating to BBB-

The rating for Vietnam’s secured long-term debt was raised to BBB-, equivalent to investment grade, one notch higher than the country’s long-term foreign-currency rating on unsecured debt, which remains at BB+. The upgrade followed Fitch’s review under its revised Sovereign Rating Criteria issued in last September, said the Ministry of Finance.

-

Interest rate developments applied by credit institutions in December 2025

State Bank of Vietnam has just released the interest rate developments of credit institutions in December 2025.

-

Deposit interest rates exceed 7%, pushing up lending rates

Deposit interest rates at mid-sized banks have continued to rise and surpass the 7 per cent per year mark, causing lending rates to increase.

-

Higher 2026 growth target puts pressure on credit framework

Vietnam’s credit growth framework is set to face mounting pressure as policymakers pursue a significantly higher economic growth target in 2026.

-

Vietnam’s corporate bond market set for a more positive 2026

2026 is set to be a more positive and active year for Vietnam's corporate bond market, bolstered by an improving credit quality trend.

-

Treasury’s idle funds deposited at banks proposed to raise at year end

The Ministry of Finance has recently proposed allowing the State Treasury of Vietnam to increase the cap on idle funds deposited at commercial banks to improve liquidity during the year-end period.

-

Credit growth plans at 15% in 2026, focusing on macroeconomic stability

Under the latest statement on managing credit growth in 2026, the SBV said that this year it will focus on maintaining macroeconomic stability and sustainable development, and control risk areas and real estate.

-

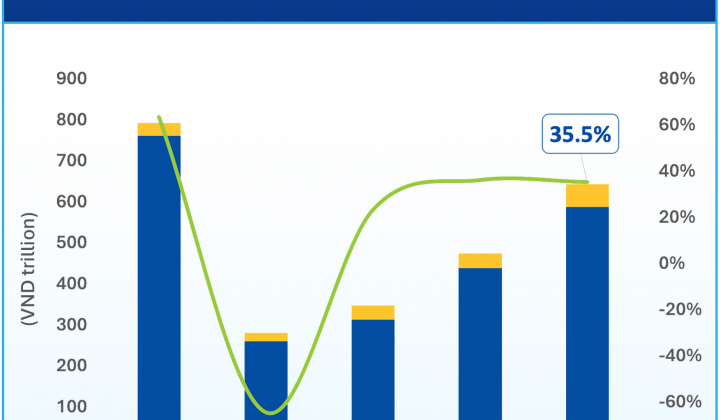

Banks lead the bond market with nearly 590 trillion VND

2025 concluded with many positive signs for the Vietnamese corporate bond market, as the volume of new issuances recorded strong growth, and the issuance structure gradually stabilized compared to the previous period of significant volatility.

-

Financial scams surge ahead of Tết

As the Lunar New Year (Tết) approaches, financial and banking scams in Việt Nam are showing a sharp upward trend, making banks and law enforcement agencies continuously issue warnings.

-

Banks set for selective hiring in 2026

Vietnam’s banking sector is entering 2026 with a more targeted approach to hiring, reflecting improving business conditions and evolving operational demands. Recruitment plans point to steady expansion rather than broad-based workforce growth.

-

On the management of credit growth in 2026

For the year 2026, the SBV sets a system-wide credit growth target of approximately 15%.