News

-

JBIC and BIDV join forces to back Vietnam’s green transition

Japan and Vietnam are stepping up cooperation on decarbonisation, aiming to boost renewable energy and sustainable growth.

-

HDBank joins forces with FMO to advance green finance

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) has expanded its international sustainability agenda through a new cooperation agreement focused on advancing green finance.

-

Sacombank launches green finance package, advancing its ESG commitment

Sacombank advances sustainability commitment with new green finance package

-

One Shinhan Career Fair: Explore Valuable Career Opportunities with Shinhan Financial Ecosystem in Vietnam

Ho Chi Minh City, 17 November 2025 – Shinhan Bank Vietnam, together with its subsidiaries—Shinhan Securities, Shinhan Life, and Shinhan Finance—held the “One Shinhan Career Fair 2025” on 14 November 2025, offering students valuable career opportunities across Shinhan’s financial ecosystem in Vietnam after graduation.

-

Shinhan Bank Collaborates with Visa to Launch Global Trade Payment Platform (GTPP)

Ho Chi Minh City, on 17 November 2025 – Shinhan Bank Vietnam Limited (“Shinhan Bank”) collaborated with Visa to launch Global Trade Payment Platform (“GTPP”) that assists enterprises to make cross-border payment by Shinhan cards quickly, safely and effectively. This is the first time that GTPP is launched by Visa in Vietnam’s market and Shinhan Bank is the first foreign bank in Vietnam supporting this GTPP.

-

MB releases report “Banking Industry & the New Generation of Consumers”

Hà Nội, November 15, 2024 – The Military Commercial Joint Stock Bank (MB) today announced the publication of its latest industry report titled “Banking Industry & the New Generation of Consumers.” The report provides an in-depth analysis of how emerging consumer generations—Millennials (Gen Y), Generation Z, and the rising Generation Alpha—are reshaping the future of banking in Vietnam and the wider region.

-

ANNOUNCEMENT: LPBank Board of Directors approves the organization of the 2025 Extraordinary General Meeting of Shareholders

The Board of Directors of Lien Viet Post Commercial Joint Stock Bank (LPBank) has just issued a Resolution on the organization of the Extraordinary General Meeting of Shareholders (EGM) for 2025.

-

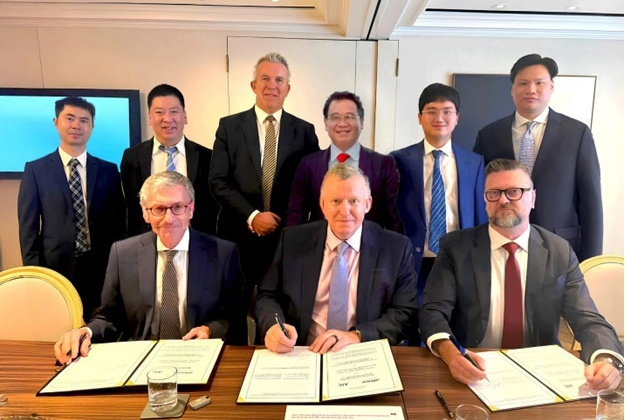

KBC, AIC, and VietinBank sign MoU to develop $2 billion data centre

Kinh Bac City Development Holding Corporation has signed an MoU with Accelerated Infrastructure Capital (AIC) and VietinBank to jointly develop a 200MW AI data centre in Tan Phu Trung Industrial Park, Ho Chi Minh City.

-

Techcombank secures higher rating from Fitch Ratings and S&P Global Ratings

Within three months, Techcombank has consistently been rated highly by two of the world’s leading credit rating agencies, Fitch Ratings and S&P Global Ratings, reaffirming the bank’s robust capital base, effective risk management, and sustainable growth strategy.

-

BIDV becomes Việt Nam’s first commercial bank accredited by the Green Climate Fund

The recognition was approved at the 43rd GCF Board Meeting, marking a major milestone in BIDV’s journey towards sustainable finance and its leadership in green growth.

-

Shinhan Bank launches Đống Đa Branch, expanding its network to 56 locations nationwide

Shinhan Bank Vietnam Ltd. (“Shinhan Bank”) has launched its Đống Đa Branch at 1st Floor, No. 11A Cát Linh Street, Ô Chợ Dừa Ward, Hanoi, bringing the Bank’s total number of branches and transaction offices to 56 nationwide.The opening of Đống Đa Branch is part of Shinhan Bank’s selective network expansion strategy for 2025, aiming to enhance service quality and operational efficiency while offering customers a convenient and secure financial experience.

-

ACCA and MSB strengthen strategic partnership to elevate financial talent standards

The Association of Chartered Certified Accountants (ACCA) has awarded the ACCA Approved Employer certificate to the Vietnam Maritime Commercial Joint Stock Bank (MSB), recognising the bank's commitment to fostering an internationally accredited environment for professional learning and human resource development.