News

-

Developments of interest rates applied by credit institutions (February 2025)

The interest rates of deposits in VND: The average deposit interest rates in VND were at 0.1-0.2% p.a. for demand and below 1-month terms;

-

Central bank required to consider proposals on Basel III application

Prime Minister Phạm Minh Chính has directed the State Bank of Vietnam (SBV) to consider commercial banks’ proposals on implementing Basel III international banking standards.

-

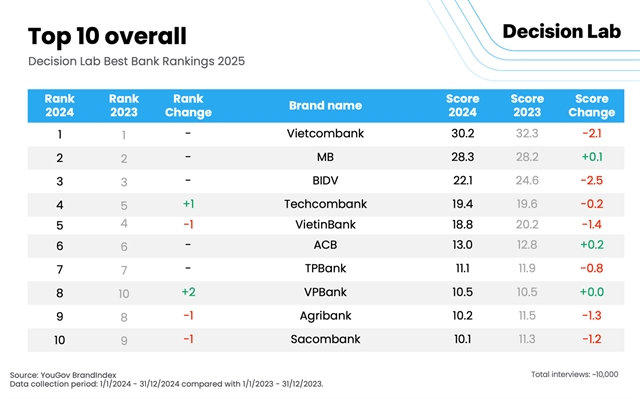

Top-performing banks in Việt Nam unveiled

The 2025 rankings reveal a slight decline in overall brand health scores across the banking sector, which is attributed to reduced marketing investments in 2024. As banks scaled back promotional efforts, the market stabilised, resulting in minimal shifts in brand performance.

-

Foreign ownership at acquirers of weak banks to rise to 49%

The new decree also regulates that the total share ownership of foreign investors at a Vietnamese non-bank credit institution will also not be allowed to exceed 50 per cent of the institution’s charter capital.

-

IFC, SECO Strengthen Partnership to Bolster Supply Chain Finance

To boost the competitiveness of Vietnamese smaller businesses, IFC, the Embassy of Switzerland, local authorities and business stakeholders celebrated the launch of the second phase of their supply chain finance (SCF) program. With a five million Swiss Francs grant from the State Secretariat for Economic Affairs (SECO) through 2029, this initiative aims to help over half a million Vietnamese small and medium enterprises (SMEs) access up to $35 billion in working capital.

-

EIB to help SBV in promoting green finance

On March 12, 2025, Deputy Governor Nguyen Ngoc Canh met with Ms. Nicola Beer, Vice President of the European Investment Bank (EIB), at the headquarters of the State Bank of Vietnam (SBV)

-

Banking sector aims to lend $2.78 million in Region 4 in 2025

The provinces in Region 4 are important geographical locations, with Lào Cai and Hà Giang bordering with China to the North, and Vĩnh Phúc and Phú Thọ bordering with Hà Nội to the South.

-

SBV requests banks to proactively supply credit for rice production, processing, and export in Mekong Delta

Implementing the direction of the Prime Minister on the management to ensure the balance of rice supply and demand amid global and domestic market developments, and to promptly meet the credit needs for the production, processing, temporary storage and export of rice, especially for the purchase of commercial rice in the 2025 Winter-Spring crop in the Mekong Delta provinces, the State Bank of Vietnam (SBV) has requested the SBV branches No. 13, 14, and 15 to implement a number of key tasks.

-

Banks adjust to balance and cut costs

With simultaneous interest rate cuts and accelerated credit disbursement, banks are fuelling Vietnam’s economic breakthrough, driving towards the ambitious targets of 8 per cent GDP growth and 16 per cent credit expansion this year.

-

Deputy Governor Pham Tien Dzung meets Senior Executive Vice President of ICBC

On February 28th, 2025, at the headquarters of the State Bank of Vietnam (SBV), Deputy Governor Pham Tien Dzung had a meeting with Mr. Zhang Wei Wu, Senior Executive Vice President of the Industrial and Commercial Bank of China (ICBC). Also attending the meeting, one the SBV’s side, there were representatives of the International Cooperation Department, the Payment Department, and the National Payment Corporation of Vietnam (NAPAS).

-

Measures to reduce lending interest rates to promote economic growth

On the afternoon of March 5, 2025, in Hanoi, the Government Office held a regular Government press conference for February 2025.

-

Commercial banks upbeat about achieving high profits in 2025

Vietnamese commercial banks are optimistic about their 2025 profit targets, with many expecting increases of 20 per cent to 30 per cent due to anticipated robust economic growth and a resurgence in credit activity.