On the morning of October 3, 2025, the State Bank of Vietnam (SBV) held a press conference to announce the banking sector’s performance in Q3/2025. The conference was chaired by SBV Deputy Governor Pham Thanh Ha, with the participation of representatives from relevant SBV departments, the Vice Chairman and Secretary-General of the Vietnam Banks Association, leaders of commercial banks, and numerous reporters from media outlets.

Credit Developments: Strong Capital Injection – Priority for Production and Business

Deputy Governor Pham Thanh Ha

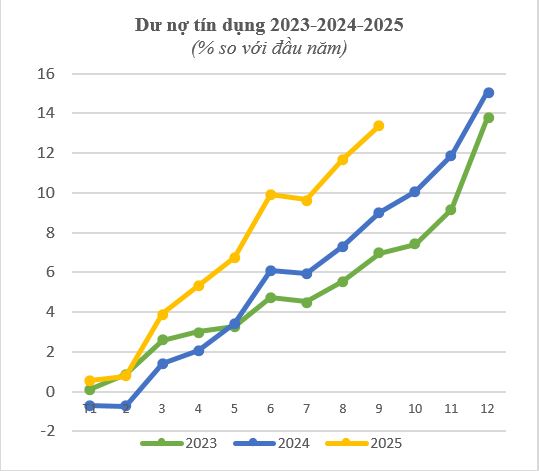

At the press conference, Deputy Governor Pham Thanh Ha stated that as of September 29, 2025, total outstanding credit in the system reached approximately VND 17.71 quadrillion, up 13.37% compared to the end of 2024. This growth equates to more than VND 2.1 quadrillion in new capital disbursed during the first nine months, averaging around VND 230 trillion per month—evidence that capital flows from the banking system are pouring robustly into the economy.

The 13.37% credit growth rate is the highest in recent years and is expected to serve as a “launch pad” for even higher growth by year-end. According to Deputy Governor Ha, if conditions remain favorable, total credit growth in 2025 could reach 19–20%.

Ms. Ha Thu Giang, Director General of the Credit Department for Economic Sectors

Regarding credit structure, Ms. Ha Thu Giang, Director General of the Credit Department for Economic Sectors, said that credit continues to be channeled primarily into production and business activities, accounting for about 78% of total outstanding loans. Priority sectors such as agriculture (22.76%) and small and medium-sized enterprises (19.04%) also received significant attention. By industry, agriculture–forestry–fishery accounted for 6.23%, industry–construction 23.97%, and trade–services 69.8% of total outstanding loans.

Several government-directed credit programs also recorded stronger progress. Cumulative disbursements for agriculture, forestry, and fishery projects reached nearly VND 106 trillion, exceeding targets, with total program scale raised to VND 185 trillion. Lending for social housing (under Resolution 33) and for buyers under 35 years old reached about VND 4.7 trillion, up 66.2% from the end of 2024. Notably, the “Big Four” state-owned commercial banks alone disbursed nearly VND 19.335 trillion for housing support programs for those under 35. These figures highlight the trend that credit is not spread thinly but rather concentrated in key sectors such as agriculture, SMEs, and high technology—aligned with government and SBV policy directions.

Lower Interest Rates Easing Business Pressure

One of SBV’s strategic objectives is to keep policy rates low to reduce capital costs for businesses and households. At the press conference, Deputy Governor Ha emphasized: “Inflation is well controlled… the 8-month average was 3.25%; core inflation was 3.19%, contributing to macroeconomic stability. Loan interest rates for new credit have been adjusted down to 6.52% per year, about 0.41 percentage points lower than at the end of 2024.”

Mr. Pham Chi Quang, Director General of the Monetary Policy Department

According to Mr. Pham Chi Quang, Director General of the Monetary Policy Department, this was achieved by requiring credit institutions to cut operating costs, strengthen IT applications and automation, and reduce unnecessary staffing. However, he warned: “Ensuring ample capital supply for the economy does not mean being complacent about inflation… SBV continuously reviews to balance growth and inflation control.”

Mr. Quang further noted: “Alongside supporting growth, there are potential risks of rising bad debts.” Rapid credit growth is positive, but if lending quality is not strictly controlled—especially in high-risk sectors like real estate—non-performing loans may increase. SBV will continue to supervise lending quality, restrict short-term loans for long-term investments, and tighten real estate lending ratios when necessary.

Electronic Payments & Digital Transformation: A "Leverage" for Banking Development

Parallel with expanding credit, the banking sector continues to invest heavily in technology, promoting cashless payments and digital transformation. Electronic payments have rapidly expanded in both user base and transaction value. SBV is developing legal frameworks, implementing sandboxes to test new models, and enhancing payment security. Credit institutions are urged to reduce costs, accelerate fintech partnerships, and improve service efficiency.

Meeting panorama

On the regulatory side, SBV has continued to refine mechanisms and policies for cashless payments and digital transformation, creating consistency and favorable conditions for development, while ensuring security and safety in payment activities. This facilitates access for citizens and businesses to modern, convenient services and methods. Overall, e-payment policies are becoming a key pillar to reduce costs, enhance competitiveness, and support long-term lending rate reductions for the economy.

Statistics on Transactions and Payment Infrastructure (Jan–Aug 2025)

|

Category |

Period |

Volume/Scale |

Value |

Change in Volume (%) |

Change in Value (%) |

|

Non-cash payments (total) |

Jan–Aug 2025 vs. 2024 |

- |

- |

↑ 43.53% |

↑ 24.24% |

|

Internet Banking |

Jan–Aug 2025 vs. 2024 |

- |

- |

↑ 50.52% |

↑ 36.00% |

|

Mobile Banking |

Jan–Aug 2025 vs. 2024 |

- |

- |

↑ 37.46% |

↑ 21.14% |

|

QR Code |

Jan–Aug 2025 vs. 2024 |

- |

- |

↑ 63.65% |

↑ 152.97% |

|

ATMs (number of machines) |

End of Aug 2025 |

20,940 ATMs |

- |

↓ 0.83% |

- |

|

POS (number of terminals) |

End of Aug 2025 |

831,408 POS |

- |

↑ 19.03% |

- |

|

Cards in circulation |

End of Aug 2025 |

160.3 million cards |

- |

↑ 2.61% |

- |

|

ATM Transactions |

Jan–Aug 2025 vs. 2024 |

- |

- |

↓ 16.49% |

↓ 5.67% |

Gold Market Management: Enhancing Transparency

One of the most notable highlights of 2025 is Decree No. 232/2025/ND-CP amending and supplementing Decree No. 24/2012/ND-CP on gold trading management, which takes effect on October 10, 2025. It introduces three fundamental changes:

-

Abolishing the State monopoly on gold bar production, shifting to licensing qualified enterprises and banks for production.

-

Allowing raw gold imports, with expanded participation from enterprises and banks.

-

Strengthening transparency and accountability across import, production, and distribution processes.

In addition, all gold bar transactions worth VND 20 million or more must be settled through bank accounts.

Mr. Dao Xuan Tuan, Director General of the SBV Foreign Exchange Management Department

Ending the monopoly will diversify and improve transparency of gold supply, narrowing the domestic–international price gap. According to Mr. Dao Xuan Tuan, Director General of the SBV Foreign Exchange Management Department: “All processes and trading information will be disclosed publicly and transparently to prevent market distortions.”

In practice, qualified banks and enterprises have promptly completed applications for licenses to import raw gold and produce gold bars. Asia Commercial Bank (ACB) was the first to announce resumption of gold bar trading from October 10, 2025, with ACB, SJC, and other brands permitted by regulation.

Decree 232 is widely viewed as a “strong reform” in gold market management, aiming at transparency, reducing risks, and curbing speculation and price manipulation. However, its implementation will still require guiding circulars, licensing, and supervision of import, production, and trading processes. During this transition, risks of smuggling or underground trading may arise if not tightly managed. SBV will coordinate with relevant agencies to strengthen inspection, ensure transparency, and strictly handle violations to maintain market stability.

VNBA News